reverse sales tax calculator california

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Qst stands for quebec sales tax.

Fastest Sales Tax Reverse Calculator 2022 2023

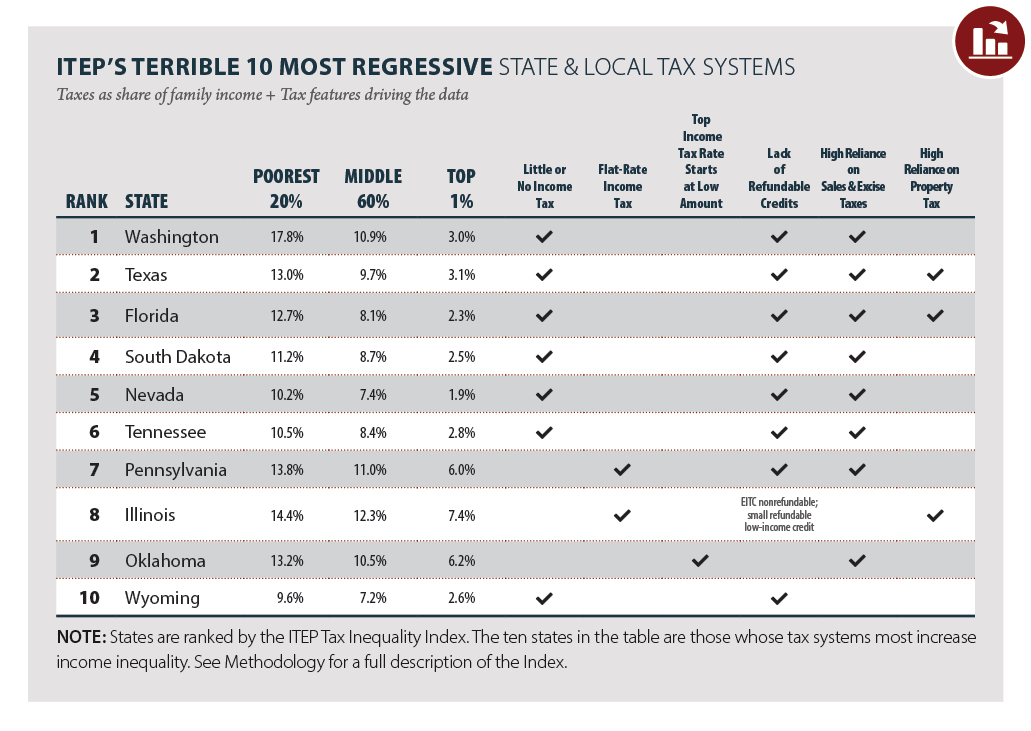

Reverse tax calculation of product costing USD 100 based on 10 tax rate 100-1001001101090909.

. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. The only thing to remember about claiming sales. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Use our sales tax calculator to determine the amount of sales tax owed on a purchase. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. To calculate the sales tax backward from the total divide the total amount you received for the items subject to sales tax by 1 the sales tax rate.

To calculate the sales tax backward from the total divide the total amount you received for the items subject to sales tax by 1 the sales tax rate. Calculate Reverse Sales Tax. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Current hst gst and pst. Here is how the total is calculated before sales tax. Have you checked the California sales calculator.

For example say youre buying a new coffee maker for your kitchen. Calculate sales tax using this free tool. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

Simply enter the purchase price and the sales tax rate to. Here is how the total is calculated before sales tax. Add tax amount to list price to get total price.

The price of the coffee maker is 70 and your state sales tax is 65. California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that. Beware some bars restaurants charge a tip on the amount ttc while it.

You can calculate the Sales Tax amount you paid employing any reverse Sales Tax Calculator sometimes called the Sales Tax deduction calculator or using a. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more. For instance in Palm Springs California the total.

You can calculate the reverse tax by dividing your tax receipt by 1 plus. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. This reverse tax calculator will help.

For example if the sales tax rate is 6 divide. Enter the sales tax percentage. Please visit our State of Emergency Tax Relief page for.

Current hst gst and pst.

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Sacramento County Sales Tax Rates Calculator

Why You Should Work With A State And Local Tax Salt Consultant Taxjar

How To Calculate California Sales Tax 11 Steps With Pictures

California Proposes 16 8 Tax Rate Wealth Tax Again Time To Move

How To Calculate Sales Tax In Excel

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

What Is A Reverse Mortgage Money Money

How To Calculate Sales Tax Backwards From Total

How To Calculate Sales Tax Backwards From Total

Sales And Use Tax Audits In 2021

California Sales Tax Calculator Reverse Sales Dremployee

5 Sales Tax Calculator Template

Fastest Sales Tax Reverse Calculator 2022 2023

Reverse Sales Tax Calculator De Calculator Accounting Portal

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System